You will find that improved credit makes you feel like you have just lost weight. Don’t seek a quick fix – we can help you establish and/or manage your credit responsibly over time.

- Are you living paycheck to paycheck each month, or cannot save/plan for the future because you don’t earn enough money?

- Do you have financial goals but are confused as to which one to address first?

- Are you a victim of predatory lending, costly financial scams, or awful interest rates?

- Are most things in your financial life costing you more than your neighbors and friends?

- Do you want to reduce your credit card debts and expenses but don’t know how?

- Are you behind on your mortgage or other monthly payments, and can’t seem to make progress?

- Do you want to develop a workable spending and savings plan to get you out of debt?

- Do you have some big expenses and want to avoid using credit cards to pay for them?

- Do you need counseling that can help you improve your credit?

There are many families today who cannot manage their money. Their monthly income is too little to keep up with their needs. Like them, you may not be able to repay your monthly debts, and fall prey to all kinds of predatory financial scams. You are taking on more debts than you can actually repay. You are in foreclosure, about to lose your home or business, and are denied loans or credit each time you apply. Your debt ratio is high and your credit rating is poor. You need some help now if you are unable to save for the future!

There is good news! ADC is “Your guide to financial success in America”. We can provide you with free, confidential financial counseling and education to help you take control of your finances, master your money, and reach your goals. Our financial counseling services provide you with full professional assistance to address all aspects of your personal financial situation. We’ll work with you to avoid or resolve financial distress and provide you information and support that will help you achieve your goals, such as buying a home, starting a business, or saving for the future.

Financial Education

ADC Financial Counseling Service promotes financial literacy. We believe that financial education creates choice and the opportunity to build a financial future. We provide workshops for all age and gender groups. We deliver these programs to community groups, classes and employers, and also offer “train-the-trainer” sessions for groups or agencies.

We offer financial education in three ways:

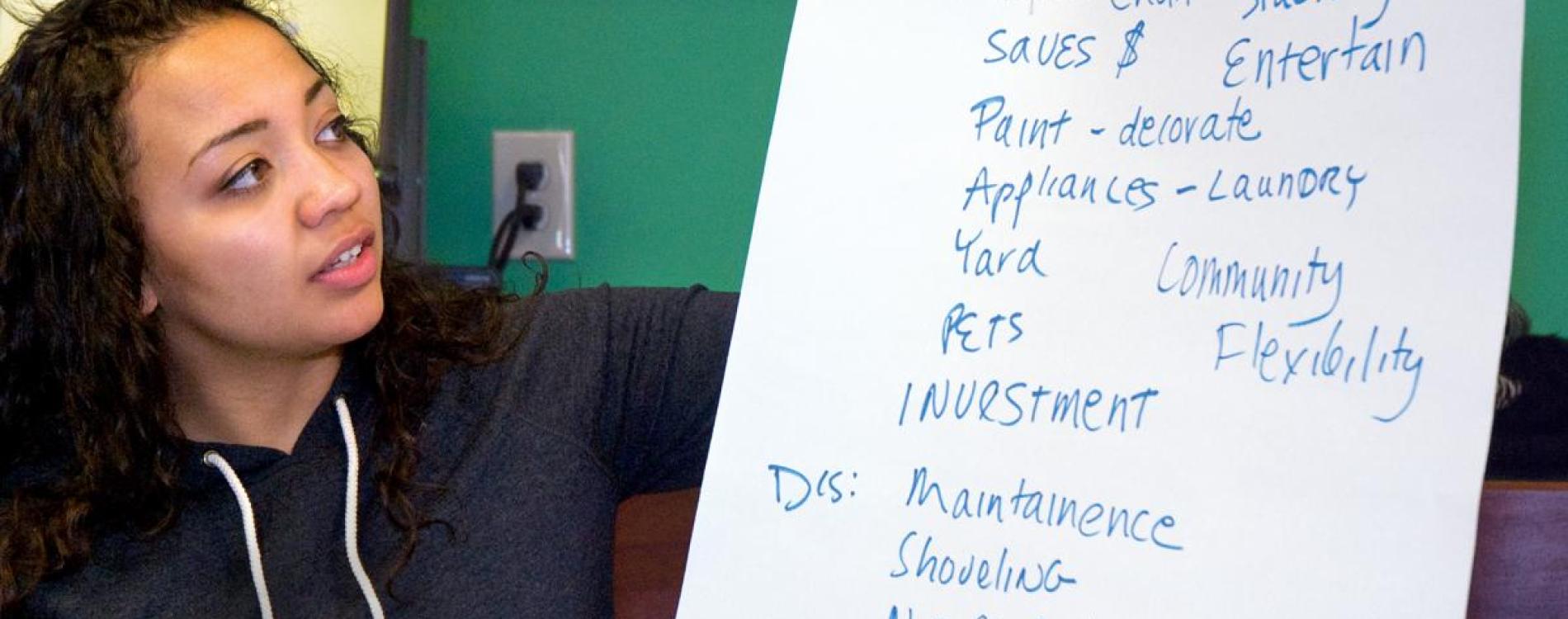

I. Financial Education Workshops

- Money Management

- Consumer protection and identity theft

- Finding money to start saving and investing

- Living on reduced income during transitions

- Building good credit to improve your score

II. Financial Literacy Classes

- Budgeting to create savings

- Debt reduction and asset building

- Improving credit rating

- Consumer protection and financial institutions

III. Train-the-Trainer

These sessions usually take 8 to 10 hours total, depending on the participants and the depth of exercises. This special training is for front-line workers to build the technical financial expertise and comfort to facilitate financial coaching and classes with their clients.

Appointments

Mondays – Fridays, 9am – 5pm

Average counseling session is two (2) hours - first session. There is no limit on the number of sessions.

Fee

Credit Report Fee: $35.00